Shanghai Auto Show: Car manufacturers adapt to changing dynamics in the smart driving market.

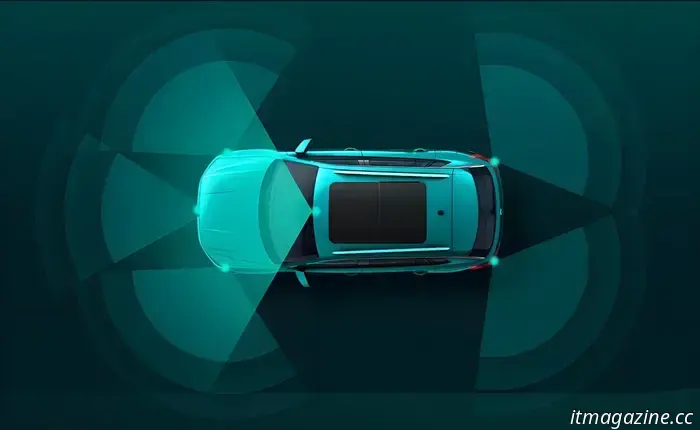

Established automakers as well as electric vehicle manufacturers are actively showcasing their assisted driving technologies at this year's Shanghai Auto Show, despite Beijing recently tightening safety regulations on in-car systems following a deadly incident involving a Xiaomi EV. Concurrently, China’s annual auto shows are evolving to feature tech startups like Momenta and Pony.ai—an event highlight—as the push for "smartification" makes progress in the world’s largest EV market. These developments reflect findings from a recent AlixPartners survey indicating that China is increasingly recognized as a leader in intelligent driving systems due to efficient data collection and processing, as well as a more accommodating market landscape, among other reasons. Nearly 60% of passenger cars sold in China last year included Advanced Driver Assistance System (ADAS) features, compared to under 40% in the U.S. As automakers navigate technological advancements, shifting consumer preferences, and regulatory hurdles, notable trends in autonomous mobility at Auto Shanghai 2025, which concludes on May 2, are emerging.

Safety is a primary concern. Just a month ago, leading Chinese auto and tech companies were determined to meet ambitious deadlines to introduce "door-to-door" ADAS features with “human-like” driving capabilities. However, now, nearly all enterprises have pivoted to prioritize vehicle safety. On April 27, Huawei announced the launch of safety “training camps” for drivers in partnership with 11 auto manufacturers, a similar initiative by Xpeng. Geely referenced the term “safety” over 60 times during a 20-minute press conference, while global leaders like Toyota and Audi expressed concerns regarding the rapid progression in vehicle development. According to AlixPartners, Chinese manufacturers have reduced the development time for new EVs to 22 months, unlike traditional brands which require at least 32 months, primarily by minimizing physical tests and issuing software updates to resolve issues. Paul Gong, head of China auto research at UBS, noted during a media briefing on April 25 that some Chinese companies may have taken shortcuts in testing their vehicles. He indicated a probable slowdown in the issuance of new assisted driving software updates in the months ahead. Ismail Dagli, Head of Continental's Autonomous Mobility Business Area, emphasized that Level 2 ADAS systems must enhance safety as they gain broader acceptance due to increased usage, stating on April 24 that the rollout of "Beta programs," which allow drivers to test their ADAS, will be prohibited.

The Zeekr 9X is slated for a global release in Q3 2025, alongside the operation of V4 Ultra-Fast charging stations capable of peak charging speeds of 1.3 MW.

This year’s Auto Shanghai also marked a significant moment for an expanding group of local autonomous driving developers that have largely gone unnoticed, with global manufacturers forming collaborations in China to leverage the impressive tech ecosystem. Hong Kong-listed Horizon Robotics revealed that Chery, a major Chinese automaker, will be its first client for the “Horizon SuperDrive” ADAS solution, while over 200 vehicle models from Volkswagen and BYD already incorporate its computing platforms. Earlier this year, Horizon Continental Technology (HCT), a joint venture between Horizon and Continental, announced it had secured an angel round funding of "several hundred million RMB" from investors including Hillhouse Capital and the CICC Porsche fund. Dagli noted that HCT effectively merges AI development and data-driven performance with the risk awareness characteristic of a German company.

Momenta has signed agreements to provide assisted driving technologies for more than 130 car models, with intentions to expand these technologies into international markets like Germany, France, and Japan. The Toyota and GM-backed firm is reportedly seeking to raise as much as $300 million in a U.S. IPO. Competitor Deeproute, a startup from Shenzhen, has formed partnerships with major companies such as Great Wall Motors and Smart, a Mercedes-Benz brand. As per Gong's insights, many automakers may be shifting from internal development to outsourcing to Chinese suppliers for their competitive intelligent driving systems, leading to lower R&D costs and increased productivity.

Juergen Brandl, Head of the Autonomous Mobility Business Area at Continental China, noted a "significant improvement" in ADAS functionalities, such as the City NOA (Navigation on Autopilot), in recent months due to advancements in computing power and camera technologies. This rapid growth has prompted several firms to advance, with Xpeng, Zeekr, and GAC among the early adopters planning to launch vehicles equipped with Level 3 autonomous driving capabilities this year. Nevertheless, most companies remain hesitant about semi-autonomous driving, despite encouragement from Beijing, except for a few that have already trialed Level 3 features.

An Aion V, jointly developed by GAC and ride-hailing service Didi, was showcased at the Shanghai Auto Show on April 23, 2025. One major concern is that automakers must accept full legal accountability for their vehicles while the L3 conditional autonomous driving feature is in

Other articles

This budget 4K television has become even more economical.

The Onn 50-inch 4K Roku TV is currently on sale for $200, reduced from its original price of $330. You can take advantage of this deal by buying it at Walmart.

This budget 4K television has become even more economical.

The Onn 50-inch 4K Roku TV is currently on sale for $200, reduced from its original price of $330. You can take advantage of this deal by buying it at Walmart.

Amazon Fire TV Omni Mini-LED enhanced with interactive artwork and dual audio features.

Amazon's top Fire TV model is receiving an anticipated update that enhances screensavers with interactivity and offers assistance for individuals using hearing aids.

Amazon Fire TV Omni Mini-LED enhanced with interactive artwork and dual audio features.

Amazon's top Fire TV model is receiving an anticipated update that enhances screensavers with interactivity and offers assistance for individuals using hearing aids.

Samsung suggests that the upcoming Galaxy Watch will concentrate on these three aspects.

Samsung has provided a few clues regarding its upcoming Galaxy Tab and Galaxy Watch during an earnings call.

Samsung suggests that the upcoming Galaxy Watch will concentrate on these three aspects.

Samsung has provided a few clues regarding its upcoming Galaxy Tab and Galaxy Watch during an earnings call.

7 top films of 2025 up to this point

Curious about the entertaining films you might have overlooked at the box office? Here are the 7 top movies of 2025 so far.

7 top films of 2025 up to this point

Curious about the entertaining films you might have overlooked at the box office? Here are the 7 top movies of 2025 so far.

NYT Strands for today: clues, spangram, and solutions for Wednesday, April 30.

Strands offers a challenging twist on the traditional word search from NYT Games. If you're having difficulty and can't figure out today's puzzle, we've got assistance and clues for you right here.

NYT Strands for today: clues, spangram, and solutions for Wednesday, April 30.

Strands offers a challenging twist on the traditional word search from NYT Games. If you're having difficulty and can't figure out today's puzzle, we've got assistance and clues for you right here.

Ayaneo’s latest Android handheld features an improved display and a quicker processor.

The Ayaneo Pocket S2 is an upgraded Android handheld, and its release date has now been revealed.

Ayaneo’s latest Android handheld features an improved display and a quicker processor.

The Ayaneo Pocket S2 is an upgraded Android handheld, and its release date has now been revealed.

Shanghai Auto Show: Car manufacturers adapt to changing dynamics in the smart driving market.

Automakers are adapting to advancements in technology, evolving consumer tastes, and regulatory hurdles, while China is being recognized more and more as a frontrunner in intelligent driving systems.