What is Eutelsat, the emerging competitor to Starlink in Europe?

Last week, French satellite operator Eutelsat gained attention as a possible alternative to Elon Musk’s Starlink in Ukraine, and perhaps across Europe as well. Eutelsat's CEO, Eva Berneke, indicated that the company was in advanced negotiations with the EU regarding the expansion of its internet services in Ukraine. She also mentioned engaging in “very positive discussions” with Italy to provide an encrypted communication service for government officials. In response to this news, investors rallied behind Eutelsat, causing its shares to surge by over 500%.

But what is Eutelsat exactly? And is it feasible for Eutelsat to replace Starlink in Ukraine and beyond?

A mission for independence

In 1977, 17 European nations established the European Telecommunications Satellite Organisation, also known as “Eutelsat.” The goal was to create a satellite-based telecommunications infrastructure that would be independent of both the US and the Soviet Union. In 1983, Eutelsat became the first European satellite TV provider. It was privatized in 2001, and in 2023, it merged with the UK’s OneWeb, becoming the third-largest satellite operator globally.

With this merger, Eutelsat took over OneWeb’s constellation of low-Earth orbit satellites for internet services, which is a similar model to its larger competitor Starlink.

How do OneWeb’s satellites operate?

Eutelsat currently has 653 OneWeb satellites orbiting at approximately 1,200 km above the Earth. This nearer placement allows for lower latency and quicker internet speeds in comparison to traditional geostationary satellites, which are about 30 times farther away. Ground stations on Earth connect to the internet and send data to the orbiting satellites. The satellites then relay this data to user terminals, small devices equipped with antennas that provide internet access in areas lacking conventional connections. These user terminals are particularly valuable in remote locations, on airplanes, ships, vehicles, or — as seen in Ukraine — conflict zones.

Can Eutelsat replace Starlink in Ukraine?

Eutelsat informed TNW that it provides comparable coverage and latency capabilities to Starlink. The company's low-Earth orbit (LEO) services are already operational in Ukraine, facilitating government and institutional communications. Moreover, Eutelsat noted that its geostationary orbit (GEO) systems could offer additional capacity in Ukraine and enhance the resilience of critical infrastructure connectivity.

Currently, Eutelsat has about 2,000 user terminals deployed in Ukraine, a significantly smaller number compared to Starlink's 40,000. Berneke mentioned that her company could reach the 40,000 figure "in a couple of months." However, scaling up that quickly would entail substantial logistical hurdles, especially since OneWeb terminals are sourced from third-party providers, unlike Starlink which manufactures its own.

Support from countries like Poland and the US has helped finance Ukraine’s use of Starlink, and similar backing would likely be necessary for a rapid deployment of OneWeb terminals, particularly given Eutelsat’s financial challenges.

Furthermore, there are technical considerations. OneWeb’s satellites are older and less sophisticated than Starlink’s, lacking the inter-satellite laser link technology that enhances coverage. They also orbit with far fewer satellites than Starlink, which operates around 7,000 satellites.

If the EU is intent on replacing Starlink in Ukraine, it will more than likely have to accept a less optimal alternative. Significant financial investments will also be required. Positive news emerged from Poland over the weekend, as the country’s foreign minister noted that they would have to “look for other suppliers” if SpaceX “proves to be an unreliable provider.” Currently, Warsaw finances half of the 42,000 Starlink terminals operating within its borders at an annual cost of around $50 million.

Looking ahead, Europe is banking on IRIS², a multi-orbit satellite internet constellation expected to launch by 2030. Additionally, reports suggest that a new joint venture involving Airbus, Leonardo, and Thales Alenia Space called “Project Bromo” aims to compete with Starlink’s global leadership.

The topic of Europe’s technological sovereignty will be a major discussion point at the TNW Conference scheduled for June 19-20 in Amsterdam. Tickets for the event are available now, and using the code TNWXMEDIA2025 at checkout offers a 30% discount.

Other articles

Google Gemini is set to take on a more significant role in your workplace.

Gemini is enhancing your online work meetings by introducing new features to Google Meet and Google Chat.

Google Gemini is set to take on a more significant role in your workplace.

Gemini is enhancing your online work meetings by introducing new features to Google Meet and Google Chat.

iRobot introduces an extensive range of budget-friendly Roomba robot vacuums.

iRobot is preparing for its largest product launch to date, with several robot vacuums available for presale on March 18. Here's a preview of what will be coming later this year.

iRobot introduces an extensive range of budget-friendly Roomba robot vacuums.

iRobot is preparing for its largest product launch to date, with several robot vacuums available for presale on March 18. Here's a preview of what will be coming later this year.

I can't stop contemplating this mysterious new game focused on AI.

Centum, a mysterious new point and click adventure game released today for PC and Switch, is the oddest game we've encountered this year.

I can't stop contemplating this mysterious new game focused on AI.

Centum, a mysterious new point and click adventure game released today for PC and Switch, is the oddest game we've encountered this year.

Today, this Samsung Dolby Atmos soundbar is available with a $500 discount.

The Samsung HW-Q850D Dolby Atmos Soundbar is currently available for $600. Enjoy immersive surround sound with a substantial discount of $500.

Today, this Samsung Dolby Atmos soundbar is available with a $500 discount.

The Samsung HW-Q850D Dolby Atmos Soundbar is currently available for $600. Enjoy immersive surround sound with a substantial discount of $500.

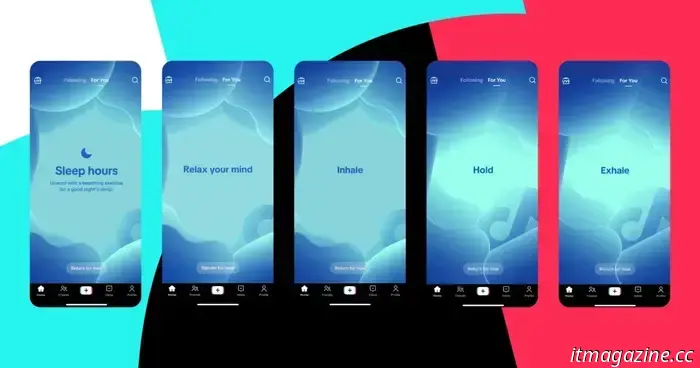

TikTok will break into teens’ late-night scrolling sessions with soothing music.

Any teenagers using TikTok after 10 PM will now get a reminder to relax and take a breath, along with calming music.

TikTok will break into teens’ late-night scrolling sessions with soothing music.

Any teenagers using TikTok after 10 PM will now get a reminder to relax and take a breath, along with calming music.

What is Eutelsat, the emerging competitor to Starlink in Europe?

Rising worries about Starlink's future in Ukraine are heightening interest in Eutelsat, a competing satellite internet provider.