Seven Chinese companies to watch after 2025, spanning from drones to gaming.

Reflecting on 2025, I prefer to highlight a selection of Chinese companies I have followed for years and truly believe in. While they may not be at the forefront of the latest trends, each has solidified its standing in its respective field through innovation, quality products, and long-term investments. These seven companies vary widely in their focuses, spanning sectors from drones and robotics to GPUs, new energy, designer toys, and domestically developed games. Collectively, they represent, in my opinion, the most noteworthy Chinese companies to watch beyond 2025.

DJI: one of the few Chinese tech firms excelling globally

By 2025, DJI has little left to prove. In the realm of both consumer and enterprise drones, it remains the benchmark against which all others measure themselves, particularly in imaging and automation. DJI has evolved beyond merely a hardware manufacturer. Over the years, it has created a cohesive system that integrates flight control, computer vision, algorithms, and supply chain management — a level of engineering expertise that is increasingly rare. This year, DJI has taken its camera business more seriously, which is significant. The Osmo 360, released in July, quickly captured 43% of the global panoramic camera market in its first quarter, leaving competitors scrambling. By applying its imaging technology developed for drones to handheld devices, DJI is establishing itself as an imaging platform company, rather than just a brand centered on several flagship products.

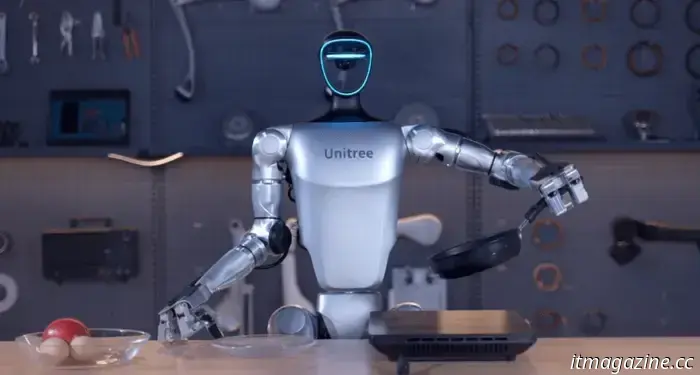

Unitree: proving that humanoid robots are truly becoming functional

Despite numerous headlines about robots in recent years, Unitree is among the few companies committed to tackling the fundamental and less glamorous aspects of robotics. By 2025, it has largely shed the image of simply being a hype-driven robot dog company. Gradually, it has been focusing on foundational elements — motors, control algorithms, and cost management — and whether it's quadrupeds or humanoid robots, its products are evolving towards something viable for sale and use. The introduction of its in-house M107 joint motor, along with the G1 humanoid robot priced at RMB 99,000 ($14,000), signifies a notable transformation. For the first time, humanoid robots are moving from PowerPoint presentations and trade shows to a more attainable price point. Widespread adoption is still distant, but at least the trajectory is now evident and promising.

Pop Mart: evolving beyond just blind box sales

By 2025, considering Pop Mart as merely a blind box company feels outdated. It has transformed into a long-term IP enterprise, concentrating on understanding the emotional shifts among young consumers and meticulously developing characters over time. Through international expansion, localized IP strategies, and a steady stream of new series, collaborations, and experiential offerings, Pop Mart has revitalized its IPs, evolving them from collectible toys into enduring cultural icons. Pop Mart now boasts a portfolio of well-known IPs, including Labubu, Molly, Dimoo, PUCKY, Skullpanda, and the Little Twin Stars (Kiki & Lala) collaboration. Each character possesses a unique personality and visual aesthetic, ranging from whimsical to more fashion-forward styles, reflecting the diverse preferences of younger consumers.

Moore Threads: persevering in a challenging landscape

It's well known how arduous the GPU journey is. By 2025, Moore Threads continues to face significant challenges, yet it remains a company to monitor in the long term. From its inception, it opted for the most difficult route: developing a fully functional GPU. Rather than narrowing its focus, it has diligently worked to complete the entire stack, including graphics, AI computing, and the software ecosystem. The GPU landscape is never just a short-term endeavor; it's an endurance challenge. Whether Moore Threads can gain a competitive edge remains uncertain, but simply surviving and progressing is a substantial achievement. Geopolitical factors complicate the situation, with specific chips and technologies facing sanctions and export restrictions intensifying pressure on resources and supply chains. This adds to the significance of Moore Threads’ long-term commitment, making it even more noteworthy.

BYD: transforming new energy into a comprehensive industrial system

BYD has always struck me as a stable entity. By 2025, it no longer appears as a youthful newcomer but rather as a well-operated industrial powerhouse. It has successfully transformed new energy from a concept into a replicable and scalable system, covering everything from batteries to complete vehicles and large-scale manufacturing. As global competition intensifies, BYD continues to maintain its foothold. This resilience stems not from chance, but from its scale, cost management, and extensive experience accrued over the years. While it may not generate significant excitement, it is undeniably hard to overlook.

CATL: consistently the strongest competitor in batteries

No matter how fierce the industry's price wars escalate, CATL remains the most reliable player. By 2025, its advantage in power batteries transcends mere technological leadership, encompassing mass production capabilities, an extensive customer base, and comprehensive system capabilities. More importantly,

Other articles

Govee's vision for smart lighting extends further than just providing light.

Govee’s presentation at CES 2026 suggests a future in which smart lighting responds to mood, routines, and wellbeing, rather than solely to schedules and commands.

Govee's vision for smart lighting extends further than just providing light.

Govee’s presentation at CES 2026 suggests a future in which smart lighting responds to mood, routines, and wellbeing, rather than solely to schedules and commands.

Rumors about the arrival of Apple's 'affordable' MacBook intensify.

Apple is reportedly set to introduce a budget-friendly 12.9-inch MacBook featuring an A18 Pro chip in the spring of 2026, broadening its range of laptops.

Rumors about the arrival of Apple's 'affordable' MacBook intensify.

Apple is reportedly set to introduce a budget-friendly 12.9-inch MacBook featuring an A18 Pro chip in the spring of 2026, broadening its range of laptops.

Here are the upcoming electric vehicles to anticipate in 2026.

QuickCharge: This Week in EV This article is a segment of our ongoing series, QuickCharge: This Week in EV. Updated less than a day ago. Following years of consistent advancement, 2025 posed a significant challenge for electric vehicles (EVs). The actions taken by the Trump Administration to eliminate the federal EV tax credit and limit emissions standards, along with additional...

Here are the upcoming electric vehicles to anticipate in 2026.

QuickCharge: This Week in EV This article is a segment of our ongoing series, QuickCharge: This Week in EV. Updated less than a day ago. Following years of consistent advancement, 2025 posed a significant challenge for electric vehicles (EVs). The actions taken by the Trump Administration to eliminate the federal EV tax credit and limit emissions standards, along with additional...

HP's CES 2026 lineup has been leaked, showcasing the EliteBook, OmniBook, and OMEN AI PCs.

Leaked information about HP's plans for CES 2026 reveals a significant focus on AI in their EliteBook business laptops, OmniBook consumer devices, OMEN gaming products, Chromebooks, and accessories.

HP's CES 2026 lineup has been leaked, showcasing the EliteBook, OmniBook, and OMEN AI PCs.

Leaked information about HP's plans for CES 2026 reveals a significant focus on AI in their EliteBook business laptops, OmniBook consumer devices, OMEN gaming products, Chromebooks, and accessories.

iOS 27 has the potential to bring about five significant changes that will transform your experience with the iPhone.

iOS 27 may lack the dazzling new features typically anticipated from an annual update, but its emphasis on enhancing the existing foundations will transform the iPhone experience permanently.

iOS 27 has the potential to bring about five significant changes that will transform your experience with the iPhone.

iOS 27 may lack the dazzling new features typically anticipated from an annual update, but its emphasis on enhancing the existing foundations will transform the iPhone experience permanently.

The new Plaud NotePin S has the potential to transform the way you take notes.

Plaud's latest NotePin S is designed for users who are always on the move, featuring wearable AI for notetaking. Meanwhile, its desktop application broadens the company's emphasis on virtual meetings and hybrid work environments.

The new Plaud NotePin S has the potential to transform the way you take notes.

Plaud's latest NotePin S is designed for users who are always on the move, featuring wearable AI for notetaking. Meanwhile, its desktop application broadens the company's emphasis on virtual meetings and hybrid work environments.

Seven Chinese companies to watch after 2025, spanning from drones to gaming.

Reflecting on 2025, I prefer to concentrate on a collection of Chinese companies that I have closely monitored for years and truly have faith in. They might not be at the