Opinion: Space startups are shifting their focus to defense. This is beneficial for innovation.

A few months back, during the SmallSat Symposium, a panel delivered a serious warning to space startups: avoid pursuing defence funding at the cost of long-term sustainability. The reason? Companies, especially in the space industry, might be tempted to chase money instead of concentrating on delivering valuable products and services with more extensive, enduring applications. It's certainly wise for any company to be cautious about getting too invested in what might be fleeting trends. However, the warning fails to acknowledge a crucial reality: the shift towards defence investment is not just a trend. It signifies a transformation within the space sector and its investments, which will likely lead to positive — albeit unintended — outcomes.

There has been a clear trend in the space industry towards focusing predominantly on defence investments. Firms that once emphasized commercial uses, or at least had dual-use business models, are now shifting entirely to defence. This transition is not incidental; it is influenced by geopolitical developments, such as the ongoing situation in Ukraine, and a widespread belief that the global landscape is evolving. As Michael Gove, who served in the cabinets of four British prime ministers, recently remarked: “The ideal of a rules-based international order, with multilateral institutions curbing states pursuing their self-interest, has been revealed as a false hope… we are reverting to a reality akin to that of Thucydides, where the strong act as they wish and the weak bear the consequences.”

This transformation is also evident at the public sector level. In 2024, global government spending on space initiatives rose to $135 billion (€119 billion), reflecting a 10% increase from the previous year, primarily driven by heightened defence budgets. A recent Bruegel report indicated that without U.S. support, “Europe could require 300,000 additional troops and an annual increase in defence spending of at least €250 billion” to maintain safety on the continent. Amid escalating geopolitical tensions, governments around the globe have been directing funds towards space-based defence technologies, recognizing that this sector is foundational to modern military capabilities.

One of the unintended yet highly advantageous outcomes of this shift for startups is its influence on the private space sector. Increased investment in defence is revitalizing aerospace and deep technology innovation. Firms that previously faced obstacles in securing commercial funding are now benefiting from consistent government investment, enabling them to develop cutting-edge technologies. This includes, among others, optical communications essential for secure and high-speed data transmission in space; Earth observation vital for climate tracking, disaster management, and resource oversight; and synthetic aperture radar (SAR), which offers precise imaging capabilities regardless of weather or time of day.

Despite the promising prospects, transitioning from purely commercial to defence markets presents challenges. Startups may encounter significant hurdles, as government contracts often involve delayed payments and lengthy procurement processes, resulting in cash flow issues for smaller companies that don't have sufficient financial reserves. Moreover, technologies related to defence are subject to strict export regulations and compliance demands, imposing bureaucratic challenges that many startups may not be prepared to manage.

However, for those firms that successfully navigate this transition, the benefits significantly outweigh the challenges. Defence funding offers long-term stability and a pathway for companies to create world-class technology that could later be commercialized in other markets. In effect, shifting into the space sector doesn’t necessitate abandoning the commercial landscape.

Some startups are making significant shifts to defence, but the real advantage lies in dual-use technology — innovations that cater to both commercial and defence markets. Companies that achieve this balance enjoy diversified revenue streams, enhanced resilience against market fluctuations, and the flexibility to adjust focus as commercial needs evolve.

The success of this dual-use strategy is evident in companies that have effectively integrated their products across various sectors. Consider ICEYE, a SAR satellite firm whose data is utilized for flood management, maritime surveillance, and in conflict zones such as Ukraine. Or FibreCoat, which produces advanced materials that shield satellites from harsh space conditions, regardless of the satellites' uses.

Given the extent of government investments and the ongoing volatility in the geopolitical environment, it is improbable that the current emphasis on defence signifies merely a passing trend. A new world order is emerging, and considerations of national security will heavily influence geopolitics in the coming years.

However, the ultimate objective for the space industry should be to foster a balanced ecosystem where defence and commercial initiatives support each other. The current increase in defence spending is accelerating technological innovation, providing infrastructure that will ultimately benefit the commercial sector over time. As companies keep developing dual-use technologies, they can ensure that the innovations driven by defence needs also promote broader commercial advancement.

This is encouraging news because space impacts nearly every facet of modern life. It forms the backbone of the global economy and plays an essential role in navigation, communication, connectivity, and sustainability. According to a McKinsey and World Economic Forum report, the space economy is expected to reach $1.8 trillion (€1.58 trillion) by 2035. We may be entering a new golden age for the industry, characterized by greater access

Other articles

UK executives declare AI to be as 'socially essential' as water and energy.

A recent survey of 500 business professionals in the UK found that two-thirds of respondents consider AI to be socially essential, comparable to water and electricity.

UK executives declare AI to be as 'socially essential' as water and energy.

A recent survey of 500 business professionals in the UK found that two-thirds of respondents consider AI to be socially essential, comparable to water and electricity.

A guide for moving your startup to Valencia.

Valencia's expanding startup ecosystem presents European and non-European entrepreneurs with a new hub for innovation to develop and expand their businesses.

A guide for moving your startup to Valencia.

Valencia's expanding startup ecosystem presents European and non-European entrepreneurs with a new hub for innovation to develop and expand their businesses.

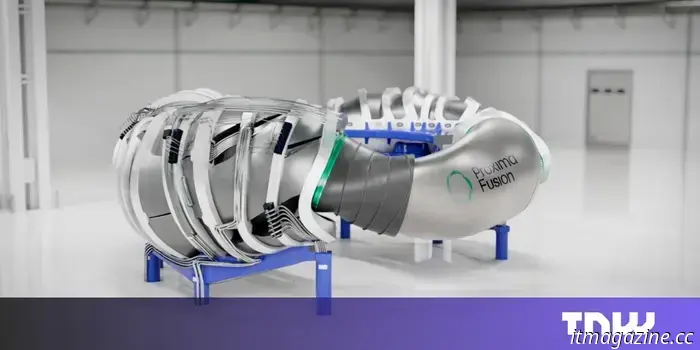

European venture capitalists have placed a historic investment on this lesser-known fusion energy contender.

Only two years after coming out of stealth mode, German startup Proxima Fusion has secured Europe's largest private investment in fusion energy to date.

European venture capitalists have placed a historic investment on this lesser-known fusion energy contender.

Only two years after coming out of stealth mode, German startup Proxima Fusion has secured Europe's largest private investment in fusion energy to date.

Engineered artificial solar eclipse in Europe provides fresh perspective on the Sun.

Two satellites have successfully created an artificial solar eclipse, allowing scientists to gain new insights into the Sun's outer atmosphere.

Engineered artificial solar eclipse in Europe provides fresh perspective on the Sun.

Two satellites have successfully created an artificial solar eclipse, allowing scientists to gain new insights into the Sun's outer atmosphere.

7 TNW Conference sessions we’re looking forward to

The TNW Conference unites Europe’s brightest thinkers, most daring startups, and revolutionary technology in Amsterdam on June 19 and 20.

7 TNW Conference sessions we’re looking forward to

The TNW Conference unites Europe’s brightest thinkers, most daring startups, and revolutionary technology in Amsterdam on June 19 and 20.

Quantum art, multiball, and AI-generated selfies: The top side quests at TNW 2025.

From quantum-inspired art to mixed reality games and AI photo booths, the TNW Conference 2025 presents an astounding array of side events.

Quantum art, multiball, and AI-generated selfies: The top side quests at TNW 2025.

From quantum-inspired art to mixed reality games and AI photo booths, the TNW Conference 2025 presents an astounding array of side events.

Opinion: Space startups are shifting their focus to defense. This is beneficial for innovation.

Space startups are transitioning towards defense, which is driving a fresh surge of advancements in deep tech, including optical communications and Earth observation.