European venture capitalists have placed a historic investment on this lesser-known fusion energy contender.

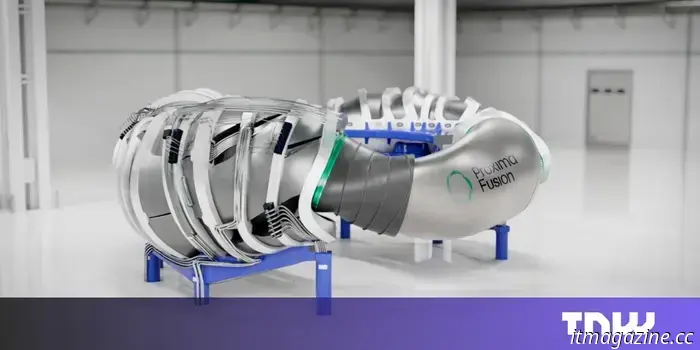

Two years ago, the German startup Proxima Fusion emerged from stealth mode with ambitious goals to position a relatively obscure stellarator fusion machine as a serious competitor in the race for commercial fusion energy.

Recently, the Munich-based company secured Europe’s largest private investment in fusion power, raising €130 million in a Series A financing round from prominent investors such as Balderton Capital, Cherry Ventures, and Plural.

Daniel Waterhouse, a partner at Balderton Capital, now believes that Proxima has established itself as the leading "European contender" in the global competition for commercial fusion.

Proxima was the first company to be spun out from Germany's Max Planck Institute of Plasma Physics. The company’s stellarator technology uses twisted magnetic fields to contain superheated plasma, creating optimal conditions for fusion reactions between atoms.

Most current fusion projects utilize a different technology called a tokamak, which depends on symmetrical, doughnut-shaped magnetic fields. This approach is central to significant international initiatives like ITER in France and is favored by well-funded startups such as the US-based Commonwealth Fusion Systems and the UK’s Tokamak Energy.

Stellarators are more challenging to construct but offer several advantages over tokamaks. They require less power to function, and their twisted design simplifies the control of plasma. In theory, they can operate continuously without interruptions.

Francesco Sciortino, co-founder and CEO of Proxima Fusion, stated that he believes stellarators are the only fusion technology that ensures continuous operation, an essential characteristic for future fusion reactors.

“Though they are more complex to design, we think stellarators will surpass tokamaks because they are easier to operate and more suitable for power generation,” he remarked.

Francesco Sciortino, co-founder and CEO of Proxima Fusion, speaking at a company event in March 2025. Credit: Proxima Fusion

Originally conceived in the 1950s, stellarators were primarily sidelined due to their significant engineering complexities. However, advancements in AI-driven simulations are helping Proxima tackle some of these design challenges.

Ian Hogarth, a partner at Plural and an initial investor in Proxima, believes the startup’s stellarator design paves the way for Europe to take the lead in fusion technology.

“Their peer-reviewed stellarator power plant design concept validates the potential for fusion to be commercially viable, creating an opportunity for Europe to be the first to reach this goal,” he noted.

Proxima plans to complete its first demonstration device, Alpha, within six years. This machine will serve as the foundation for Stellaris, a 1GW fusion reactor that the company hopes to activate in the 2030s. However, it is not the only entity aiming to achieve a stellarator breakthrough.

In the United States, Type One Energy, backed by Bill Gates, is also pursuing ambitious goals to commercialize the stellarator. Similar to Proxima, Type One has recently unveiled peer-reviewed designs for a fusion energy reactor and aims to launch its first commercial-scale machine in the 2030s.

These two startups are among a multitude of companies worldwide attempting to establish fusion energy reactors within a similar timeframe. Some, like Helion Energy and Commonwealth Fusion, have each raised over $1 billion.

While the aspirations of fusion energy companies warrant cautious consideration, they are not entirely unrealistic. A survey conducted by the Fusion Industry Association last year found that over 70% of experts believe a fusion device will contribute to the grid by 2035.

If these predictions hold true, fusion could play a vital role in Europe’s renewable energy portfolio—offering distinct advantages. Unlike wind or solar energy, fusion could provide consistent power. Moreover, unlike fossil fuels, which are often imported from nations such as Russia and the US, fusion is clean and has the potential to be developed locally, enhancing energy security.

Nevertheless, with the US leading in private investments in fusion energy, Sciortino is concerned that Europe may miss its chance to stay competitive and has urged governments to support emerging startups.

“This is a crucial time for Europe — a moment to make decisions that will shape future decades and to take the lead in the global competition for commercial fusion,” Sciortino previously mentioned to TNW. “Europe cannot afford to waste this opportunity; it must invest in companies striving for our continent’s energy security and sovereignty.”

Looking to uncover the next big thing in technology? Join us at the TNW Conference, where thousands of entrepreneurs, investors, and corporate innovators will share their insights. The event is scheduled for June 19–20 in Amsterdam, and tickets are available now. Use the code TNWXMEDIA2025 at checkout to receive a 30% discount.

Other articles

Opinion: Space startups are shifting their focus to defense. This is beneficial for innovation.

Space startups are transitioning towards defense, which is driving a fresh surge of advancements in deep tech, including optical communications and Earth observation.

Opinion: Space startups are shifting their focus to defense. This is beneficial for innovation.

Space startups are transitioning towards defense, which is driving a fresh surge of advancements in deep tech, including optical communications and Earth observation.

UK executives declare AI to be as 'socially essential' as water and energy.

A recent survey of 500 business professionals in the UK found that two-thirds of respondents consider AI to be socially essential, comparable to water and electricity.

UK executives declare AI to be as 'socially essential' as water and energy.

A recent survey of 500 business professionals in the UK found that two-thirds of respondents consider AI to be socially essential, comparable to water and electricity.

Huawei's chairman Xu Zhijun emphasizes the need for new growth catalysts in the telecommunications sector at MWC Shanghai 2025.

During the keynote session at MWC Shanghai 2025 on Wednesday, titled The Techco Transformation: Pioneering the Next Era of Innovation, Huawei's rotating chairman Xu Zhijun gave a speech that focused on the significant growth challenges confronting the global telecom sector.

Huawei's chairman Xu Zhijun emphasizes the need for new growth catalysts in the telecommunications sector at MWC Shanghai 2025.

During the keynote session at MWC Shanghai 2025 on Wednesday, titled The Techco Transformation: Pioneering the Next Era of Innovation, Huawei's rotating chairman Xu Zhijun gave a speech that focused on the significant growth challenges confronting the global telecom sector.

Sweden reverts to traditional methods in war technology with its first TNT factory since the Cold War.

A Swedish startup is returning to the fundamentals of defense technology by establishing the nation’s first TNT production facility since the Cold War.

Sweden reverts to traditional methods in war technology with its first TNT factory since the Cold War.

A Swedish startup is returning to the fundamentals of defense technology by establishing the nation’s first TNT production facility since the Cold War.

Engineered artificial solar eclipse in Europe provides fresh perspective on the Sun.

Two satellites have successfully created an artificial solar eclipse, allowing scientists to gain new insights into the Sun's outer atmosphere.

Engineered artificial solar eclipse in Europe provides fresh perspective on the Sun.

Two satellites have successfully created an artificial solar eclipse, allowing scientists to gain new insights into the Sun's outer atmosphere.

Quantum art, multiball, and AI-generated selfies: The top side quests at TNW 2025.

From quantum-inspired art to mixed reality games and AI photo booths, the TNW Conference 2025 presents an astounding array of side events.

Quantum art, multiball, and AI-generated selfies: The top side quests at TNW 2025.

From quantum-inspired art to mixed reality games and AI photo booths, the TNW Conference 2025 presents an astounding array of side events.

European venture capitalists have placed a historic investment on this lesser-known fusion energy contender.

Only two years after coming out of stealth mode, German startup Proxima Fusion has secured Europe's largest private investment in fusion energy to date.