Mercury: superior to a bank, it's the financial operating system for your startup.

If you ask any founder, they'll tell you that banking is just the tip of the iceberg when it comes to startup finance. It's all about ensuring a steady cash flow, raising capital at the right moments, and avoiding the hassle of back-office tasks. Mercury understands this well and was specifically designed to address these needs.

Instead of being just another SaaS offering with an attractive user interface and lofty claims, Mercury is a fintech firm that has created a financial operating system. It's the kind of system you might envision when creating a startup from scratch—a single platform, specifically designed for startups, that bridges the gap from early-stage financing to Series ‘Whatever.’

From foundational elements to adaptable features

Let’s begin with the essentials. Mercury isn’t looking to completely overhaul checking and savings accounts; they simply manage traditional banking services more effectively. Deposits are insured by the FDIC for up to $5 million (via Mercury's partner banks’ sweep networks), they offer no-fee USD wires, intuitive user permissions, and direct API access for those who wish to customize their financial management. There are no hidden fees or clever upselling tactics—just straightforward banking that supports your needs.

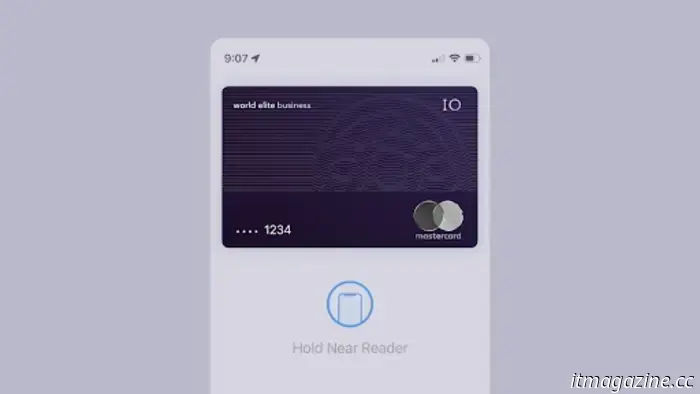

Everything seamlessly integrates. From bill payments and credit cards to invoicing, Mercury streamlines the often chaotic nature of financial operations into a surprisingly smooth process. The IO Credit Card integrates effortlessly with your account, Bill Pay automates vendor payments without the usual back-and-forth, and invoicing is natively included, saving you from switching between multiple tools to collect payments. Plus, it all works harmoniously with your accounting software.

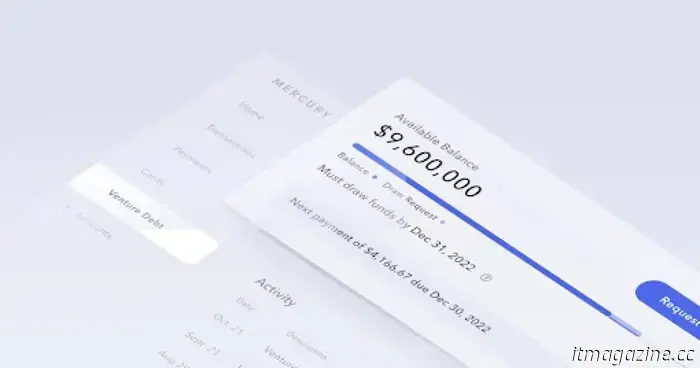

While many conventional finance companies may not understand the startup landscape as well, Mercury does. This is why it provides customized financing options like Venture Debt for VC-backed companies and Working Capital loans for e-commerce businesses. These are not generic loan products; they are created to adapt to your growth rather than hinder it.

As your business evolves, Mercury Treasury comes in to manage excess cash by allocating it into conservative, high-yield investments with daily liquidity. It’s a forward-thinking cash management solution designed for startups that have outgrown their initial phase.

Designed for creators

Mercury goes beyond just offering products; it cultivates an ecosystem that includes meaningful perks, worthwhile events, and Raise, their tool for connecting founders with investors. The platform is also SOC 2 compliant, emphasizing robust security measures.

While Mercury doesn’t aim to replace your CFO, it could quickly become their go-to resource. If you find yourself juggling several platforms for basic financial operations, it may be time to reconsider your stack. Mercury consolidates essential tools into one unified system, allowing you to focus more on revenue generation rather than money management.

Examine your current setup. If it feels fragmented, Mercury could be the enhancement your startup needs.

1Mercury is a fintech company, not an FDIC-insured bank. Checking and savings accounts are offered through partnerships with Choice Financial Group, Column N.A., and Evolve Bank & Trust; all members of the FDIC. Deposit insurance applies in the event of a bank failure. Checking and savings deposits may be held by banks in the sweep network. Specific conditions must be met for pass-through insurance to be applicable. More details can be found here.

2The IO Card is issued by Patriot Bank, Member FDIC, under a license from Mastercard®.

3Mercury's Venture Debt and Working Capital loans are originated by Mercury Lending, LLC (NMLS: 2606284) and serviced by Mercury Servicing, LLC (NMLS: 2606285).

4Mercury Treasury is provided by Mercury Advisory, LLC, an SEC-registered investment adviser. This communication does not represent an offer to sell or a solicitation to buy any security. Investments in Mercury Treasury carry risks, including possible loss of invested principal, and past performance does not guarantee future results. For complete disclosures, please visit mercury.com/treasury. Mercury Advisory is a wholly-owned subsidiary of Mercury Technologies.

Mercury Treasury is not FDIC-insured. Funds in Mercury Treasury are not deposits or liabilities of Choice Financial Group, Column N.A., or Evolve Bank & Trust and are not guaranteed by these banks.

This content has been sponsored by the indicated brands. Digital Trends collaborates with advertisers to showcase their products and services to our audience. While this article is informational and not opinion-based, it has undergone thorough verification for accuracy by our team. All branded content is produced in-house by our dedicated partnerships team, not by external advertisers. For further details about our approach to branded content, click here.

Other articles

Microsoft's Copilot Vision AI is now available for free, but only on these 9 websites.

Microsoft's Copilot AI is now capable of observing your screen while you browse, allowing you to ask it questions regarding your activities.

Microsoft's Copilot Vision AI is now available for free, but only on these 9 websites.

Microsoft's Copilot AI is now capable of observing your screen while you browse, allowing you to ask it questions regarding your activities.

Enjoyable questions to pose to ChatGPT now that it can recall all previous information.

ChatGPT can retain all your previous conversations, which means it understands you like never before. Here are some enjoyable ways to take advantage of that.

Enjoyable questions to pose to ChatGPT now that it can recall all previous information.

ChatGPT can retain all your previous conversations, which means it understands you like never before. Here are some enjoyable ways to take advantage of that.

NYT Crossword: solutions for Thursday, April 17

The crossword puzzle in The New York Times can be challenging, even if it's not the Sunday edition! If you're facing difficulties, we're available to assist you with today’s clues and solutions.

NYT Crossword: solutions for Thursday, April 17

The crossword puzzle in The New York Times can be challenging, even if it's not the Sunday edition! If you're facing difficulties, we're available to assist you with today’s clues and solutions.

UK deploys microwave weapon capable of disabling drones as part of a defense technology initiative.

The British Army has neutralized swarms of drones using the “RapidDestroyer,” a new defense technology that employs high-frequency microwaves.

UK deploys microwave weapon capable of disabling drones as part of a defense technology initiative.

The British Army has neutralized swarms of drones using the “RapidDestroyer,” a new defense technology that employs high-frequency microwaves.

The Galaxy S25 does not appear to be the success that Samsung had hoped for.

Data indicates that Samsung is just slightly ahead of Apple in terms of market share, as their strategies may not have performed as anticipated.

The Galaxy S25 does not appear to be the success that Samsung had hoped for.

Data indicates that Samsung is just slightly ahead of Apple in terms of market share, as their strategies may not have performed as anticipated.

The most intriguing feature of Gemini is now available for free to all Android users.

Google has announced that the impressive Gemini screen sharing and camera functionality will be accessible to all Android users.

The most intriguing feature of Gemini is now available for free to all Android users.

Google has announced that the impressive Gemini screen sharing and camera functionality will be accessible to all Android users.

Mercury: superior to a bank, it's the financial operating system for your startup.

Inquire with any entrepreneur, and they'll affirm that banking is just the tip of the iceberg when it comes to startup finance. The real priorities are maintaining cash flow, securing funding at crucial moments, and avoiding being overwhelmed by administrative tasks. Mercury understands this well. It was specifically designed for these challenges. Instead of being just another SaaS solution with an attractive user interface […]