The Galaxy S25 does not appear to be the success that Samsung had hoped for.

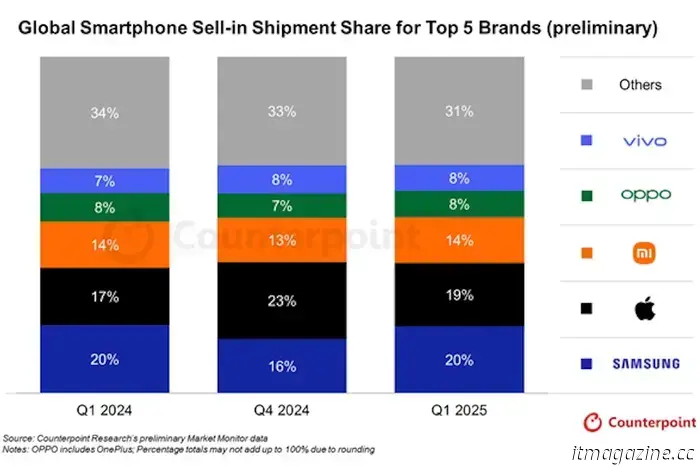

Samsung has surpassed Apple in smartphone shipment market share, based on data from Counterpoint Research. While this might seem like positive news for Samsung, a closer look at the differing strategies of both companies suggests that Samsung may not be entirely pleased with the situation. In the first quarter of 2025, Samsung held 20% of the global smartphone market by device shipments, closely followed by Apple with 19%. This data is defined as “sell in,” referring to devices bought from the manufacturer by distributors. This marks a significant shift from the last quarter of 2024, where Apple led with 23%, and Samsung trailed at 16%.

Understanding this context explains why Samsung might view these latest figures, which initially seem favorable, with some apprehension. By the end of 2024, Apple would have been benefitting from the launch of the iPhone 16 series, while Samsung would have been distanced from the release of the Galaxy S24 series, as well as the Galaxy Z Fold 6 and Galaxy Z Flip 6. It is logical for Apple to capture a larger market share immediately following the introduction of its key devices for the year.

Although Samsung regained its position on top of the global market share leaderboard at the start of 2025 with the Galaxy S25 series, it did not achieve a significant lead over Apple. Compared to the same period in 2024, Samsung has not increased its market share, maintaining a 20% share after the Galaxy S24’s launch, while Apple was at a lower 17%.

Is the Galaxy S25 failing to impress?

The Galaxy S25 series has not provided Samsung with the competitive edge it likely sought. Its shipment performance mirrors that of the Galaxy S24 series at the beginning of 2024. One common critique of the Galaxy S25 series is that its devices are not significantly different from the Galaxy S24 series, and this lack of growth compared to last year appears to corroborate these sentiments.

On the other hand, Apple shifted its strategy at the start of 2025, an approach that seems to have been effective. The Apple iPhone 16E was launched at the end of February, a departure from Apple’s typical timing for new releases, and Counterpoint Research highlights its considerable success.

“It was unusual for Apple to introduce a new product in Q1, but the launch of the iPhone 16E contributed to the brand gaining market share in regions like Japan,” wrote analyst Jene Park. “Apple topped the Q1 charts in unit sales, achieving performance stronger than any previous first quarter. The iPhone 16 series is witnessing robust demand in emerging markets where Apple has seen double-digit growth.”

Is it all doom and gloom for Samsung?

The data from Counterpoint Research may not fully account for Samsung’s latest mid-range offerings, the Galaxy A56 and Galaxy A36. Although these devices may not attract as much attention as the iPhone 16E— a model eagerly awaited by many—they tend to maintain a steady popularity throughout their lifecycle. These new models could help boost Samsung’s market share as interest in the iPhone 16E declines over the coming months.

Nonetheless, the data indicates that the Galaxy S25 has not garnered as much interest as the iPhone 16E, which reflects poorly on Samsung’s flagship lineup. This is in contrast to Samsung's claim that pre-orders for the S25 in South Korea surpassed those for the Galaxy S23 series, noting that the Galaxy S24 did not break pre-order records. The data illustrates the consumer response to two contrasting strategies—launching a mid-range device and leveraging AI to drive sales.

Samsung has heavily promoted its Galaxy AI features with the S25, which perform well, though they may not be useful to everyone on a daily basis. Given that the hardware is not significantly different from the Galaxy S24, fewer consumers may have opted to upgrade if features like the Now Brief did not appeal to them. We will be closely observing the developments surrounding the Galaxy S26 series, as Samsung might reevaluate the S25's performance and consider a strategic overhaul that could lead to more significant hardware enhancements than those seen in recent years.

Other articles

Paebbl launches the 'world's first' demonstration plant that converts CO2 into dust.

Paebbl, the startup that converts CO2 into dust, has launched its inaugural demo plant in Rotterdam, Netherlands.

Paebbl launches the 'world's first' demonstration plant that converts CO2 into dust.

Paebbl, the startup that converts CO2 into dust, has launched its inaugural demo plant in Rotterdam, Netherlands.

UK deploys microwave weapon capable of disabling drones as part of a defense technology initiative.

The British Army has neutralized swarms of drones using the “RapidDestroyer,” a new defense technology that employs high-frequency microwaves.

UK deploys microwave weapon capable of disabling drones as part of a defense technology initiative.

The British Army has neutralized swarms of drones using the “RapidDestroyer,” a new defense technology that employs high-frequency microwaves.

Could this exoplanet be 'full of life'? Clues of life beyond our solar system.

A fascinating discovery suggests the potential for life beyond our solar system.

Could this exoplanet be 'full of life'? Clues of life beyond our solar system.

A fascinating discovery suggests the potential for life beyond our solar system.

ChatGPT now understands images more effectively than both an art critic and an investigator together.

The recent image generation features of ChatGPT have posed a challenge to our earlier perceptions of AI-produced media. The newly unveiled GPT-4o model showcases impressive skills in accurately interpreting images and recreating them with viral appeal, reminiscent of styles like those from Studio Ghibli. It has also excelled in handling text within AI-generated images, a task that has been challenging for AI in the past. And [...]

ChatGPT now understands images more effectively than both an art critic and an investigator together.

The recent image generation features of ChatGPT have posed a challenge to our earlier perceptions of AI-produced media. The newly unveiled GPT-4o model showcases impressive skills in accurately interpreting images and recreating them with viral appeal, reminiscent of styles like those from Studio Ghibli. It has also excelled in handling text within AI-generated images, a task that has been challenging for AI in the past. And [...]

How Trump's tariffs may alter the future landscape for Chinese technology companies.

On Monday, January 20, President Donald Trump was officially inaugurated for his second term at the US Capitol. Present at the inauguration were various foreign dignitaries.

How Trump's tariffs may alter the future landscape for Chinese technology companies.

On Monday, January 20, President Donald Trump was officially inaugurated for his second term at the US Capitol. Present at the inauguration were various foreign dignitaries.

Lost Records: Bloom and Rage review: punk rock endures.

Lost Records: Bloom and Rage reimagines the Life is Strange formula, crafting a profoundly emotional coming-of-age narrative set in the 90s.

Lost Records: Bloom and Rage review: punk rock endures.

Lost Records: Bloom and Rage reimagines the Life is Strange formula, crafting a profoundly emotional coming-of-age narrative set in the 90s.

The Galaxy S25 does not appear to be the success that Samsung had hoped for.

Data indicates that Samsung is just slightly ahead of Apple in terms of market share, as their strategies may not have performed as anticipated.