AI currently leads product discovery for millions of individuals in the United States.

A recent study indicates that AI and social media platforms are generating unprecedented traffic for online stores, yet 80% of shoppers still leave their carts without completing a purchase.

Online retail is witnessing significant growth in traffic, but the majority of shopping experiences end without a transaction.

To investigate the underlying reasons, Semrush and Statista examined millions of shopping sessions across major e-commerce platforms.

Their report, titled “Rewriting the E-commerce Playbook: Artificial Intelligence, Social Commerce, and the Future of Consumer Confidence,” highlights that while AI tools and social commerce are transforming how Americans discover products, issues at the checkout process deter customers from completing their purchases.

The analysis identifies three key trends in online retail: the emergence of conversational search, the expansion of social shopping, and the challenges at checkout that result in significant losses for retailers.

Americans are now turning to AI for product recommendations instead of traditional searches.

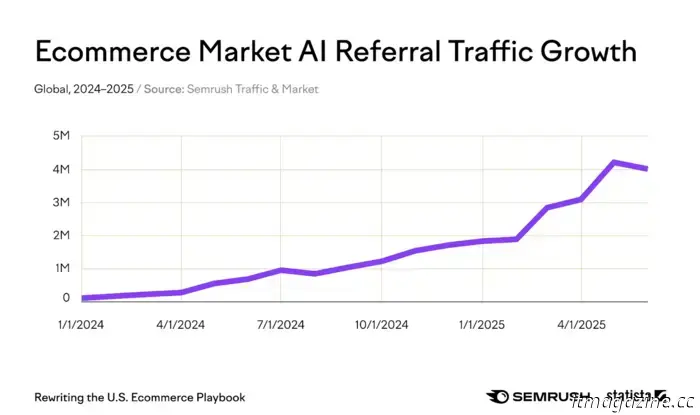

According to SEMRUSH/Statista, the report indicates that the most significant transformation in online retail is how Americans locate products. Monthly visits to shopping sites via AI assistants skyrocketed by 3,900%—growing from approximately 100,000 visits in January 2024 to more than 4 million by June 2025.

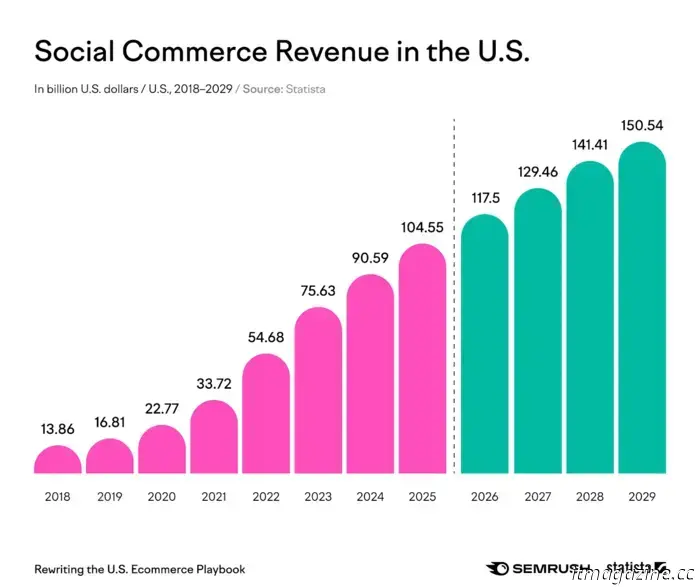

Social commerce is projected to reach $140 billion by 2028.

Platforms like TikTok, Instagram, and Facebook have emerged as key retail hubs, with commerce on these sites expected to total $140 billion by 2028.

However, there is a noticeable generational divide in social shopping behavior.

On TikTok, Generation Z leads in activity, with 87% of this demographic visiting the Shop at least once a month, and nearly 25% checking it daily. In contrast, only 23% of Baby Boomers visit the Shop monthly, with a mere 6% doing so daily.

This disparity may stem from the skepticism older Americans have towards social shopping. Generation X is particularly cautious, with 55% expressing a lack of trust in spending money on TikTok.

The gap between urban and rural shopping is exacerbated by delivery infrastructure.

The report reveals an increasing division between urban and rural online shopping habits. From 2024 to 2025, urban areas reported a boost in online shopping, while rural regions saw declines.

New York experienced the most significant rise in online shopping with a 7.6% increase, followed by metropolitan areas like Maryland (5.6%), California (5.5%), New Jersey (5.4%), and Georgia (5.2%). Meanwhile, rural states such as Montana (-6.8%), Alaska (-6.2%), and New Mexico (-5.1%) reported notable decreases in online purchases.

This divide can be attributed to basic infrastructure differences. Urban consumers benefit from same-day delivery, numerous pickup locations, and reliable internet, making online shopping smooth and convenient. Conversely, rural shoppers are challenged by slow shipping, high delivery costs, and unreliable broadband, creating a frustrating online shopping experience.

Eight out of ten shoppers abandon their carts.

Despite the advancements in AI and social shopping for product discovery, the prevalent issue of cart abandonment in online retail remains unresolved.

The report reveals that 80% of shoppers abandon their carts prior to purchase. Primary reasons for this include:

- Unexpected fees (39%). Shoppers are deterred by surprise shipping charges and taxes at checkout, turning attractive deals into unexpectedly costly purchases.

- Slow shipping (21%). Consumers expect quick delivery and are likely to abandon their carts if shipping times seem excessive.

- Required account creation (19%). Many shoppers resist creating accounts just to make a purchase, especially from lesser-known retailers.

- Security apprehensions (19%). Customers are hesitant to provide credit card details on unfamiliar websites.

What retail businesses need to do to stay competitive.

Retailers can respond to these changes by focusing on three operational strategies.

First, they should ensure that their product information is easily accessible for AI tools to recommend. Providing clear descriptions and transparent pricing upfront can assist AI assistants and minimize unexpected fees at checkout.

Second, retailers must actively post on the social media platforms where their customers are likely to discover products. For younger audiences, this means engaging on TikTok and Instagram with shoppable content and partnerships with creators. Retailers with older clientele should focus on sharing more product-centered content on Facebook.

Lastly, online retailers need to enhance their delivery speed in urban markets and improve transparency in rural ones. Urban consumers expect options for same-day or next-day delivery, while rural shoppers are open to longer delivery times but require accurate estimates.

Companies that successfully implement these three strategies will be better equipped to capture a larger share of the evolving U.S. retail market.

This analysis is derived from “Rewriting the Ecommerce Playbook: Artificial Intelligence, Social Commerce, and the Future of Consumer Confidence,” a detailed study conducted by Semrush and Statista on U.S. e-commerce trends and consumer behavior.

Altri articoli

Errori negli annunci di lavoro da evitare per attirare candidati di alto livello

Una ricerca di lavoro inizia con una piccola scelta: un titolo semplice, una fascia salariale visibile e un riassunto che rispetti il tempo. Su grandi marketplace come ZipRecruiter, quei dettagli spesso decidono cosa emerge e cosa affonda. I feed premiano la chiarezza, e i candidati scorrono velocemente, dopotutto. La posta in gioco è abbastanza semplice. Piccole modifiche potrebbero migliorare [...]

Errori negli annunci di lavoro da evitare per attirare candidati di alto livello

Una ricerca di lavoro inizia con una piccola scelta: un titolo semplice, una fascia salariale visibile e un riassunto che rispetti il tempo. Su grandi marketplace come ZipRecruiter, quei dettagli spesso decidono cosa emerge e cosa affonda. I feed premiano la chiarezza, e i candidati scorrono velocemente, dopotutto. La posta in gioco è abbastanza semplice. Piccole modifiche potrebbero migliorare [...]

L'intelligenza artificiale ora guida la scoperta dei prodotti per milioni di americani.

Un nuovo studio mostra che l'intelligenza artificiale e le piattaforme social stanno portando un traffico record ai negozi online — ma l'80% degli acquirenti abbandona comunque i carrelli. Il commercio al dettaglio online sta registrando una rapida crescita del traffico, eppure la maggior parte dei percorsi d'acquisto si conclude senza una transazione. Video consigliati Per capire perché, Semrush e Statista hanno analizzato milioni di sessioni di acquisto sulle principali piattaforme di e-commerce. Il loro […]

L'intelligenza artificiale ora guida la scoperta dei prodotti per milioni di americani.

Un nuovo studio mostra che l'intelligenza artificiale e le piattaforme social stanno portando un traffico record ai negozi online — ma l'80% degli acquirenti abbandona comunque i carrelli. Il commercio al dettaglio online sta registrando una rapida crescita del traffico, eppure la maggior parte dei percorsi d'acquisto si conclude senza una transazione. Video consigliati Per capire perché, Semrush e Statista hanno analizzato milioni di sessioni di acquisto sulle principali piattaforme di e-commerce. Il loro […]

Ho deciso quali sono i giochi di lancio della PS6 di cui Sony ha bisogno per dominare la guerra delle console di nuova generazione.

Quali sono i giochi di lancio della PS6 che garantiranno che il dominio di Sony continui? Ho qualche idea.

Ho deciso quali sono i giochi di lancio della PS6 di cui Sony ha bisogno per dominare la guerra delle console di nuova generazione.

Quali sono i giochi di lancio della PS6 che garantiranno che il dominio di Sony continui? Ho qualche idea.

AI currently leads product discovery for millions of individuals in the United States.

AI currently leads product discovery for millions of individuals in the United States.