The Hot Crazy Matrix clarifies the reasons why investors often misjudge tech deals.

Private equity transactions reached record heights in 2021, totaling over $1 trillion and marking the first instance of average deal sizes surpassing $1 billion. Founders became media favorites, valuations skyrocketed, and investors hurried to participate.

By 2023, however, many of the same firms — including Klarna and Stripe — had seen their valuations decline significantly. Klarna's value dropped by 85%, from its 2021 peak of $45.6 billion to $6.7 billion in 2022, while Stripe fell from $95 billion to $50 billion during the same period.

Today, numerous tech companies are collapsing, including no-code platform Builder.ai and fintech firms Frank and Stenn. However, investors continue to invest large sums into risky projects, especially within the AI sector. For instance, Thinking Machine Labs managed to raise an astonishing $2 billion in seed funding without any proven products.

In the rush to capitalize on the latest tech innovations, generalist investors with available capital are concentrating on personalities and promises rather than critically evaluating product value, market fit, and potential.

With $1.2 trillion in buyout capital still unallocated — much of it sitting idle for four years or more — pressure is mounting on dealmakers. When investors pursue opportunities without thorough scrutiny, their actions begin to resemble impulsive dating, reminiscent of a popular meme: the Hot Crazy Matrix.

Insights for private equity from a meme

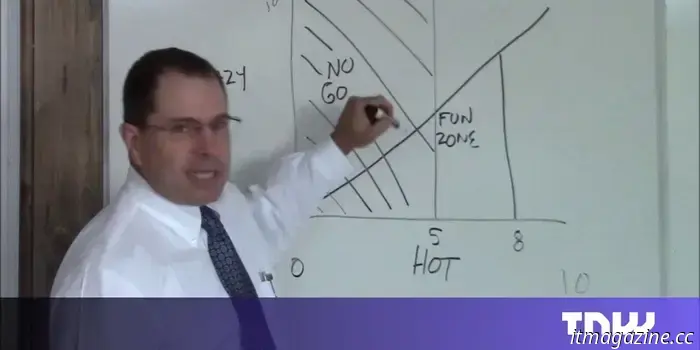

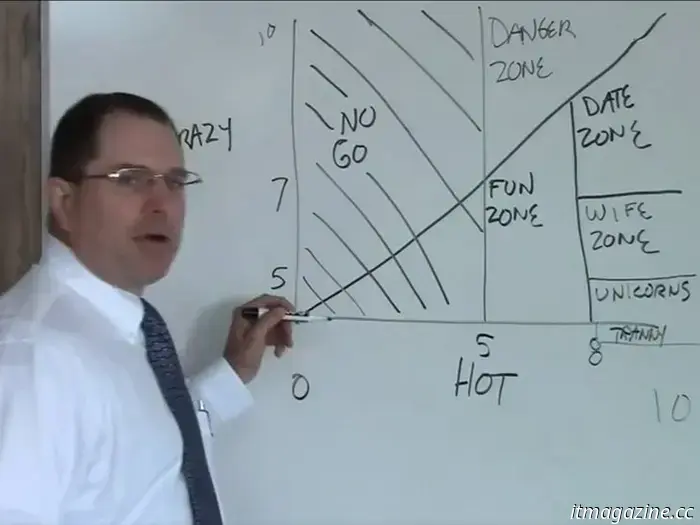

The Hot Crazy Matrix gained popularity from a viral YouTube video in the early 2000s, providing a "scientific" framework for assessing women's attractiveness across two parameters: "hot" and "crazy." While problematic, this concept can surprisingly apply to private equity.

This chart can also serve as a guide for startup investors.

Before anyone involves HR, let’s clarify that we’re not judging investors on their appearance. In this context, the "hot" horizontal axis signifies specialization; the more specific your expertise, the further right you are on the chart. This represents an investor who understands the investment thesis from the beginning.

The "crazy," vertical axis, in this private equity context, denotes the size and ambition of a fund. At the bottom are large, general investors who skim through pitch decks and call it research. At the top are niche, smaller firms that genuinely grasp what they are acquiring and how to generate value.

Identifying risk

The left side of the matrix — the no-go zone — serves as our danger zone. Here, we observe large, generic funds with substantial resources investing immense amounts without a thorough understanding of the sector, product, or commercial proposition. These investors dive in with limited ability to analyze the details. This isn’t business — it’s gambling! It may seem entertaining for a while, but don’t be surprised if you end up suffering significant losses.

To illustrate this, consider Exhibit A: Builder.ai.

Enthralled by the promise of an innovative AI-driven platform, investors, including Microsoft and Qatar’s Sovereign Wealth Fund, invested over $450 million, raising its valuation beyond $1 billion. However, behind the attractive pitch, serious flaws were overlooked: revenue numbers had been inflated by 300%, and tasks advertised as AI-generated were handled by a large team of human workers. This oversight was costly and serves as a stark reminder that deep financial resources without profound understanding can result in expensive mistakes. Such investors would fall on the left side of our matrix.

Conversely, the niche specialists — smaller private equity investors who are knowledgeable — are on the other end of the spectrum. While they possess expertise, a growing business often requires additional strength — a firm capable of making impactful changes.

Optimal partnerships

The sweet spot — or the “marriage zone” — is occupied by a fund substantial enough to engage in a complete buyout, yet knowledgeable enough to extract real value in its niche sector, such as a capital markets data company.

This leads to a beneficial cycle: expertise informs the investment, and the investment enhances even greater expertise.

But what about the elusive ideal fund? Does a large private equity firm with both extensive and specialized knowledge exist? Perhaps. However, finding one is akin to dating someone who is wealthy, compassionate, humorous, and capable of fixing your Wi-Fi. It’s possible but might take some time.

In private equity, as in dating, it’s important to look beyond appearances. Attractive pitch decks and billion-dollar valuations can be enticing, but without a clear understanding of what you're entering, you might find yourself regretting your choices. When there’s an abundance of capital but a lack of clarity, private equity demands more than just enthusiasm — it necessitates discernment.

While the Hot Crazy Matrix is a catchy internet meme, its reinterpretation imparts a serious lesson: the wisest investors aren’t simply chasing fleeting trends; they combine deep knowledge with commercial insight. Ultimately, much like successful marriages, the best deals aren

Other articles

The Hot Crazy Matrix clarifies the reasons why investors often misjudge tech deals.

The Hot Crazy Matrix is not solely applicable to dating. It can also demonstrate why investors often misinterpret tech startups and private equity transactions.