Germany secures 90% of Europe’s unprecedented defense technology funding.

Funding Focus is a new series examining the cash flow into the European tech ecosystem. Last week, we analyzed the largest investment rounds in fusion energy for this year, and now we are focusing on Europe's thriving defence tech sector.

In the first half of this year, Europe's defence tech startups attracted $971 million in funding, as venture capitalists seek to leverage the continent's effort to rearm in response to escalating geopolitical tensions. Funding in H1 2025 has already exceeded the total amount raised throughout 2024 — the previous record year — during which defence startups secured $605 million, according to Dealroom data. German startups were at the forefront, obtaining $881 million, which represents 90% of the total defence tech investments in Europe.

The majority of the funding was captured by Munich-based Helsing. In June, the startup raised an impressive €600 million ($660 million) in what is currently the largest funding round in Europe for the year. The funding round, led by Spotify CEO Daniel Ek’s venture capital firm Prima Materia, valued Helsing at €12 billion ($13.2 billion), positioning it as one of the most valuable private companies on the continent.

Founded in 2021, Helsing creates AI software for weaponry, vehicles, and military strategies. Its technology has been applied in battlefield simulations, electronic warfare for fighter jets, and drones deployed in Ukraine. The company has also announced plans for a fleet of autonomous reconnaissance submarines to enhance Europe’s maritime security.

The second largest funding round of the year went to another German firm, Quantum Systems, which raised €160 million ($176 million) at a valuation exceeding €1 billion ($1.1 billion). Quantum Systems designs electric, AI-powered autonomous surveillance drones that can be utilized for both military and civilian applications.

These unmanned aerial vehicles (UAVs) are capable of gathering intelligence on adversaries, while also being useful for farmers assessing crops, energy companies examining power lines, and search and rescue teams seeking survivors.

The third largest funding round also involved a German company: ARX Robotics, located near Munich, which secured €31 million ($34 million) in April to expand its fleet of autonomous land drones. This funding round followed ARX's announcement of plans to invest £45 million ($58 million) into a new factory in the UK.

ARX's machines operate on treads and can be outfitted with various equipment such as radar, mine-clearing devices, or medical stretchers. The largest model has the capacity to transport military loads weighing up to 500 kg, including injured personnel, across battlefields.

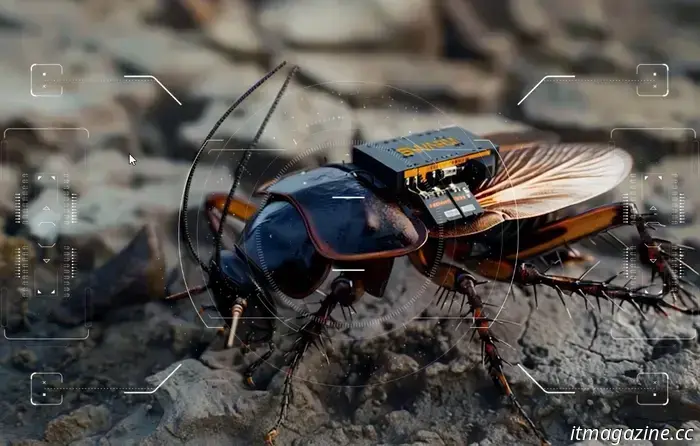

Other significant defence tech funding this year includes a $20 million round for Britain's Skyral, a startup founded by Nick Blair, son of former Prime Minister Tony Blair, which is developing military simulation technology for the UK Army and NATO. Additionally, the German startup Swarm Biotactics received €10 million ($11 million) to further develop its unique biorobotic system that outfits live cockroaches with sensors for monitoring extreme environments.

Swarm Biotactics is also creating backpacks for cockroaches that enable remote control and data collection from difficult-to-reach locations.

These investments highlight a broader surge in defence tech within Europe, as governments increasingly turn to technologies such as drones, submarines, and AI-driven weaponry. Kate Leaman, chief market analyst at online broker AvaTrade, previously mentioned to TNW that military tech companies have "huge potential" for growth, especially those with AI-based solutions.

"We’re already witnessing a transformation in the defence sector, with AI-focused firms like Palantir outperforming more traditional defence giants,” Leaman noted. “This indicates that advanced, technology-driven companies could potentially gain a significant market share.”

Other articles

Germany secures 90% of Europe’s unprecedented defense technology funding.

German startups have secured $881 million this year, accounting for 90% of Europe’s total investments in defense technology during the first half of 2025.