Samsung's budget-friendly Galaxy A07 5G may be released sooner than anticipated.

Early listings and leaked images have unveiled Samsung's Galaxy A07 5G, a straightforward budget smartphone that emphasizes modern software, 5G connectivity, and practical design over extravagant features.

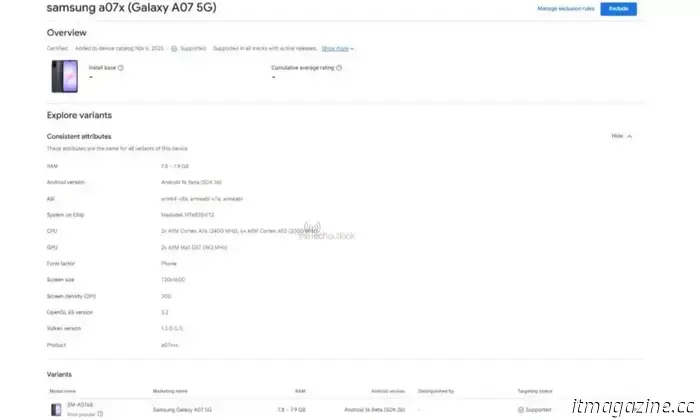

The Galaxy A07 5G, the successor to one of Samsung’s most popular budget lines, the Galaxy A series, is beginning to emerge. Identified through a Google Play Console listing (via TheTechOutlook), this phone is one of the early indicators leading up to the launch of an Android device.

The listing confirms the smartphone's model number SM-A076B, validating it as the anticipated Galaxy A07 5G. Additional important details include 8GB of RAM and a MediaTek Dimensity chipset featuring two performance cores with a clock speed of 2.40 GHz, which is thought to be the Dimensity 6300 SoC.

Out of the box, the Galaxy A07 5G is expected to run on a One UI version based on Android 16. The device is also equipped with an HD+ display with a pixel density of 300 ppi. While this information outlines the device's specifications thus far, the listing provides an initial visual glimpse as well.

The phone appears to have a U-shaped notch at the front, with prominent bezels on the sides and a noticeably thicker chin at the bottom. The power and volume buttons are situated on the right side, while the back features a vertically arranged camera module that stands out from the otherwise flat surface.

Observations suggest that the 5G version of the Galaxy A07 adopts its design from the 4G model that was launched in September 2025. Overall, the listing suggests that the Galaxy A07 5G isn’t aiming to stand out amidst a sea of entry-level 5G devices, but rather seeks to offer a refined experience.

The Galaxy A07 4G, currently available in multiple regions, comes with Samsung’s commitment to deliver six years of operating system updates, appealing to long-term consumers, which the upcoming Galaxy A07 5G is expected to uphold as well.

For over five years, Shikhar has consistently made consumer tech developments easier to understand and has communicated them effectively…

Xiaomi's S25 Ultra competitor showcases a DSLR-style physical zoom ring coupled with a 200MP zoom camera.

With a 200MP periscope lens, continuous optical zoom, and an ergonomic zoom ring, Xiaomi’s latest Ultra flagship emerges as one of the most ambitious camera phones of the year. After months of speculation, the Chinese smartphone maker has unveiled its competitor to the iPhone 17 Pro Max and Galaxy S25 Ultra: the Xiaomi 17 Ultra Leica Edition, alongside a standard Ultra version.

From the outset, it stands as one of the top camera-focused smartphones of the year, featuring a circular rear camera arrangement complete with a physical zoom ring reminiscent of DSLR cameras.

Recently, I covered a story highlighting the potential surge in smartphone prices across various segments, and now we are witnessing this theory in action with the Xiaomi 17 Ultra. The starting variant is priced higher than its predecessor, and neither Samsung nor Apple can completely evade the repercussions.

To elaborate, last year, Xiaomi introduced the Xiaomi 15 Ultra, with the base variant priced at CNY 6,499, featuring 12GB of RAM and 256GB of storage. The model with 16GB of RAM and 512GB of storage was listed at CNY 6,999.

Here are some helpful tips and tricks for your new iPhone, covering everything from setup to storage and beyond.

If you received an iPhone for Christmas, welcome aboard! After switching between Android devices for a decade, I returned to iOS with the iPhone 14 Pro in 2022, particularly after my Samsung Galaxy S10e accidentally took a dip in a pool during a holiday. Since then, I haven’t looked back, apart from being more cautious about checking my swimming shorts' pockets.

Over time, I have gained useful insights about using an iPhone. Here are some helpful suggestions to get you started.

Другие статьи

Logitech PRO X 60 сейчас почти наполовину дешевле — $89.99

Если вы хотите компактную игровую клавиатуру, не платя премиальную цену, это выгодное предложение на настоящий беспроводной вариант. Logitech PRO X 60 LIGHTSPEED снижена до $89.99 (обычная цена $179.99), что экономит вам $90. Это тот тип скидки, который делает апгрейд «приятно иметь» практичным, особенно если вы пытались […]

Logitech PRO X 60 сейчас почти наполовину дешевле — $89.99

Если вы хотите компактную игровую клавиатуру, не платя премиальную цену, это выгодное предложение на настоящий беспроводной вариант. Logitech PRO X 60 LIGHTSPEED снижена до $89.99 (обычная цена $179.99), что экономит вам $90. Это тот тип скидки, который делает апгрейд «приятно иметь» практичным, особенно если вы пытались […]

Наушники Bose QuietComfort подешевели до $199 — вы экономите $160 на повседневном шумоподавлении.

Если вы ждали настоящей скидки на надёжную пару наушников с шумоподавлением, этому предложению стоит уделить внимание. Беспроводные накладные наушники с шумоподавлением Bose QuietComfort стоят $199.00 (ранее $359), вы экономите $160. Такое снижение цены переводит их из категории «приятного апгрейда на будущее» в «покупайте сейчас, если вы добираетесь на работу», […]

Наушники Bose QuietComfort подешевели до $199 — вы экономите $160 на повседневном шумоподавлении.

Если вы ждали настоящей скидки на надёжную пару наушников с шумоподавлением, этому предложению стоит уделить внимание. Беспроводные накладные наушники с шумоподавлением Bose QuietComfort стоят $199.00 (ранее $359), вы экономите $160. Такое снижение цены переводит их из категории «приятного апгрейда на будущее» в «покупайте сейчас, если вы добираетесь на работу», […]

Реклама ChatGPT не появится в ваших чатах в ближайшее время, но OpenAI всё ещё её тестирует.

OpenAI по‑прежнему изучает рекламу в ChatGPT, сообщает новый отчет, описывающий спонсируемый контент, которому может быть отдан приоритет в ответах. Это не запуск, но реальный признак того, что идея жива.

Реклама ChatGPT не появится в ваших чатах в ближайшее время, но OpenAI всё ещё её тестирует.

OpenAI по‑прежнему изучает рекламу в ChatGPT, сообщает новый отчет, описывающий спонсируемый контент, которому может быть отдан приоритет в ответах. Это не запуск, но реальный признак того, что идея жива.

Доступный Galaxy A07 5G от Samsung может появиться раньше, чем вы думаете.

Galaxy A07 5G от Samsung предстает знакомым, но важным бюджетным смартфоном, сочетающим лаконичный дизайн, современное программное обеспечение Android и поддержку 5G по доступной цене.

Доступный Galaxy A07 5G от Samsung может появиться раньше, чем вы думаете.

Galaxy A07 5G от Samsung предстает знакомым, но важным бюджетным смартфоном, сочетающим лаконичный дизайн, современное программное обеспечение Android и поддержку 5G по доступной цене.

5 отличных телешоу, которые вам нужно посмотреть в январе 2026 года.

«A Knight of the Seven Kingdoms», «Wonder Man» и «The Pitt» — это лишь некоторые из новых сериалов, которые зрителям стоит посмотреть в январе 2026 года.

5 отличных телешоу, которые вам нужно посмотреть в январе 2026 года.

«A Knight of the Seven Kingdoms», «Wonder Man» и «The Pitt» — это лишь некоторые из новых сериалов, которые зрителям стоит посмотреть в январе 2026 года.

Первый в мире игровой монитор с частотой обновления 1080 Гц уже здесь

HKC представила игровой монитор, который достигает почти невероятной частоты обновления 1080 Гц при разрешении 720p. Это показывает, куда движутся высококлассные игровые дисплеи.

Первый в мире игровой монитор с частотой обновления 1080 Гц уже здесь

HKC представила игровой монитор, который достигает почти невероятной частоты обновления 1080 Гц при разрешении 720p. Это показывает, куда движутся высококлассные игровые дисплеи.

Samsung's budget-friendly Galaxy A07 5G may be released sooner than anticipated.

Samsung's Galaxy A07 5G is emerging as a recognizable yet significant budget smartphone, featuring a sleek design, up-to-date Android operating system, and 5G connectivity, all at a reasonable cost.